Have you ever thought about installing a solar energy system, but you’re not sure how to pay for it? Understanding the Solar Tax Credit in 2020 provides you with the knowledge you need to get started using solar energy without breaking your budget. Here’s everything you need to know about the Solar Tax Credit in 2020.

What is the Solar Tax Credit?

First and foremost you should know that the Federal Solar Tax Credit is classified as an investment tax credit, or ITC. The Federal Solar Tax Credit gives you the chance to deduct 26 percent of the cost of a solar energy installation from your federal taxes. The credit appeals to all kinds of people as it applies to both residential and commercial solar energy systems. Combined with the trend in lower solar energy prices, the Federal Solar Tax Credit is an excellent way to make your solar energy system more affordable.

How the Solar Tax Credit Works

When you’re having your solar energy system installed, be sure to keep an itemized list of all fees, costs, and expenses. There is no limit to the amount of money that you can claim in deductions through the Federal Solar Tax Credit. Everything from contractor labor to rental equipment and shipping costs is eligible under the terms of the tax credit.

Leasing a solar energy system is appealing to many homeowners. But it’s also wise to remember that the solar tax credit only applies to the installation of a system that you own. For this reason, solar leasing is not as financially advantageous over the long term.

To claim the Federal Solar Tax Credit, you’ll need to have an accurate record of all expenses incurred in the installation of your solar energy system. This means you should keep track of every receipt and bill. Next, you’ll need to fill out IRS Form 5695, where you will provide the necessary information to claim the solar tax credit. Once you complete Form 5695, you will transfer that information to your standard Form 1040 to ensure your credit is filed with the Internal Revenue Service. Of course, if you’re unsure of anything then you should consult with a certified tax specialist.

Don’t Forget The Solar Tax Credit Ends in 2022 for Residential Installations

Those who are looking to install a residential solar energy system are wise to remember that the Federal Solar Tax Credit ends in two years. Even though the initial Federal Solar Tax Credit was slated to expire back in 2007, it has received widespread support and will continue through 2022. However, anyone interested in taking full advantage of the credit should be aware of the fact that the deductible percentage of all installation costs will decrease over the coming years.

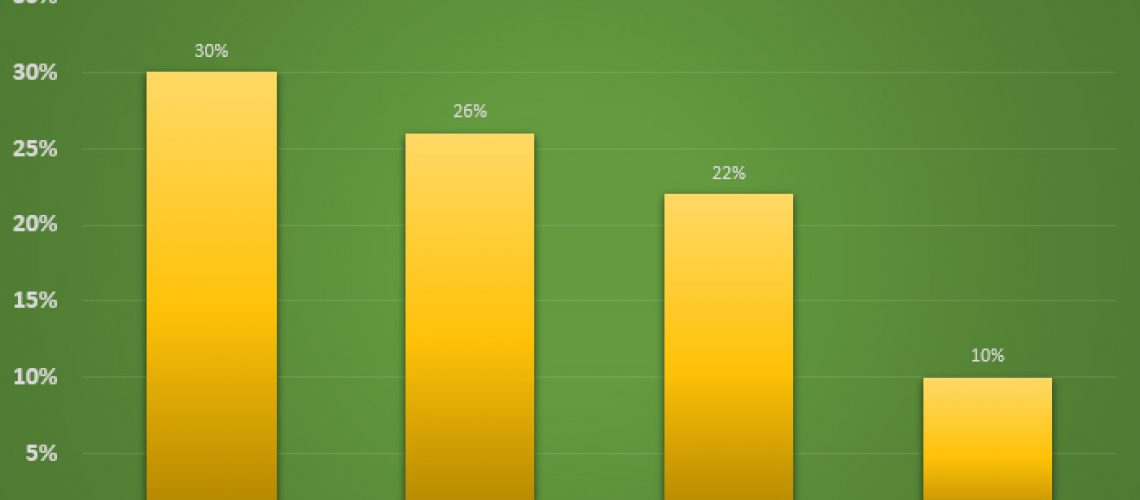

Currently, in 2020, those who install residential systems can deduct 26% of their installation costs. This figure decreases to 22% in 2021 and ends at 0% in 2022. At that point, the Federal Solar Tax Credit continues to apply for those with commercial solar energy systems at a rate of 10%. Owning a residential solar energy system is preferable to leasing one because it reduces your energy consumption and monthly bills over time. In this way, your investment compounds. Getting the full Federal Solar Tax Credit is just one more way that you can save money while also contributing to renewable energy.

As you can see, The Solar Tax Credit is an excellent way to reduce some of the costs associated with installing a solar energy system. For the maximum benefit, don’t hesitate to get your residential solar energy system installed in 2020.